is property tax included in mortgage ontario

2020 Education Tax Rate for Residential Properties in Ontario. For example the City of Toronto has a City Building Fund Levy that is used for public transit and housing projects in Toronto.

Do I Have To Pay Property Taxes Through My Mortgage Ratesdotca

The Search For The Best Mortgage Lender Ends Today.

. However there are some times when this is not ideal. So our mortgage with BMO includes the property tax component approx 95biweekly payment and this has recently changed to 185bi-weekly payment because its not enough to cover the property tax on the property. Only the interest portion of the mortgage is deductible and the interest is only deductible in the original term of the loan.

A municipal portion and an education portion. However using a strategy like the Smith Maneuver you could effectively make interest on a. MCAP will collect a set amount along with your regular mortgage payment.

Hey all been a while since Ive posted but keep reading and learning. Property tax rates also depend on the type of. MCAP will pay your property taxes on time avoiding any possibility of late fees.

The rates for the municipal portion of the tax are established by each municipality. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Generally mortgage interest for primary residences is not considered tax-deductible in Canada even where part of your house is used to run a small business.

So you would owe 4875. In comparison a similarly-priced home in Windsor which has the highest tax rate of 1818668 would have a tax bill of 909334. Property tax included in mortgage payment issue.

One less bill to worry about. Once cost often overlooked by both first-time homebuyers and seasoned homeowners is your monthly share of your property tax bill. Its Fast Simple.

I understand from this thread that the calculation goes like this assuming this is. For example a Toronto homeowner with a property valued at 500000 would pay 305507 in property taxes based on the citys rate of 0611013 the lowest on the list. Property tax is a levy based on the assessed value of property.

Property tax has two components. However its important to note that a. Ad Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

What Im trying to figure out is whether I will actually have taxes due in cash on closing or whether the remaining tax amount the HST charged less the rebate will be included in my mortgage. Get a low rate save on interest and get help from our Mortgage Advisors when you need it. Compare Apply Get The Lowest Rates.

You are required to have this insurance if you have a high-ratio mortgage or certain other types of mortgages. Dont forget though if you have any questions or would like to make any changes within your current mortgage Im always happy to take the. In a two-tiered municipality a component of the rate is set by the upper-tier and a component is set by the lower.

With tax season around the corner it is a good time to think about collecting any relevant tax documents sent by your mortgage lender so tax can be reported in your Federal income tax return. Ad See How Competitive Our Rates Are. Whichever option you decide upon will be a personal choice that suits your own needs and lifestyle though typically most homeowners will pay their property taxes through their mortgage as the pros tend to outweigh the cons.

Ad The new better way to get a mortgage in Canada. Condo owners have to collect housing information for their. The insurance does not protect the homeowner who still has to repay the lender or the insurer.

325000 market value of home x 150 property tax rate Property taxes. Most of the time your lender will collect property tax in your mortgage payment then pay your municipality on your behalf. Apply Today Save Money.

If a lump sum amount was paid to reduce the interest rate on a. Most condo owners pay condo property tax divided into 12 equal parts included in their monthly mortgage payment. Applying online is quick and easy.

For example if the market value of your home is 325000 and your municipalitys property tax rate is 15 your property taxes would be. If they are incurred for the purpose of earning income by renting property to tenants the interest portion of the mortgage is deductible on line 8710 of the T776 Rental Income form. Protects lender when borrowers cant repay their mortgage.

Some cities may add additional taxes. The MCAP Property Tax Service is complimentary for all our mortgage holders. On-time payments every time.

Should You Pay Property Taxes Through Your Mortgage Loans Canada

Land Transfer Tax Calculator A Strong Option To Get Home With Land Transfer Tax Basic Facts Life Facts Home Equity Loan

Pin On Best Ontario Mortgage Broker

Should You Pay Property Taxes Through Your Mortgage Loans Canada

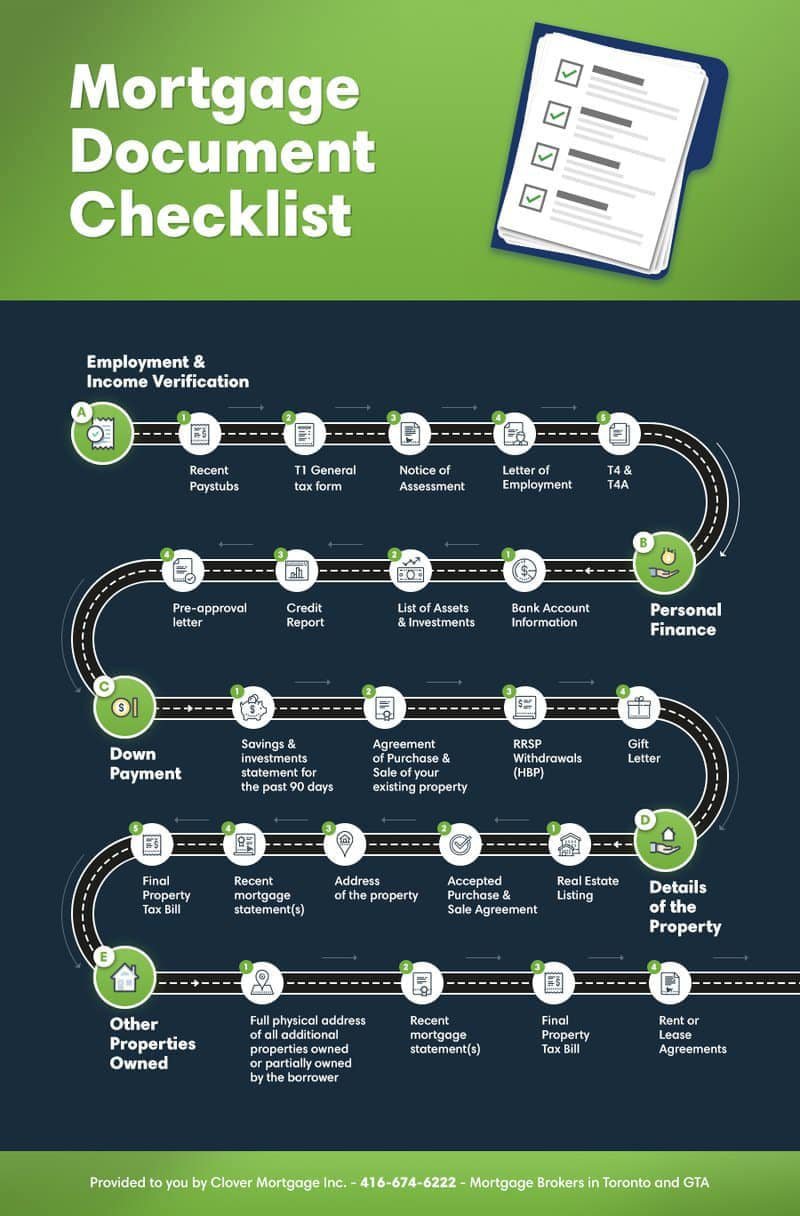

Mortgage Documents Checklist Loans Canada

Should You Pay Property Taxes With Your Mortgage

Porting Assuming Or Breaking A Mortgage What You Need To Know

Property Taxes City Of Pembroke

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Second Mortgages Second Mortgage Home Mortgage 2nd Mortgage

Should You Pay Property Taxes Through Your Mortgage Ratehub Ca

Are You Looking For A Professional With Full Service And Hands On Experience Home Buying Tips Real Estate Blog Article

Ontario Property Tax Rates Calculator Wowa Ca

Understanding Your Property Tax Bills The Town Of East Gwillimbury

Idbi Bank Home Loan Offers Flexible Loan Repayment Options And Lower Emis At Attractive Interest Rates Calculate Your E Home Loans Loan Home Improvement Loans

First Time Home Buyer In Ontario With Low Income Woodstreet Mortgage

Mortgage Document Checklist What You Need Before Applying For A Mortgage